A Guide to Challenging Your Real Estate Taxes in Ohio

If you believe your property tax bill is too high, it isn’t usually because the tax rate is wrong—it’s because the county auditor has valued your property higher than it is worth. In Ohio, you have the right to challenge this valuation through your county’s Board of Revision (BOR).

While the process is straightforward, it requires strict adherence to deadlines and solid evidence. Here is a concise guide to navigating the system.

The Critical Deadline

Timing is everything in Ohio property tax appeals. You can only file a complaint between January 1 and March 31 for the preceding tax year.

If you miss the March 31 deadline, you generally lose your right to challenge the value for that year. There are very few exceptions to this rule, so marking your calendar is the first step toward a successful appeal.

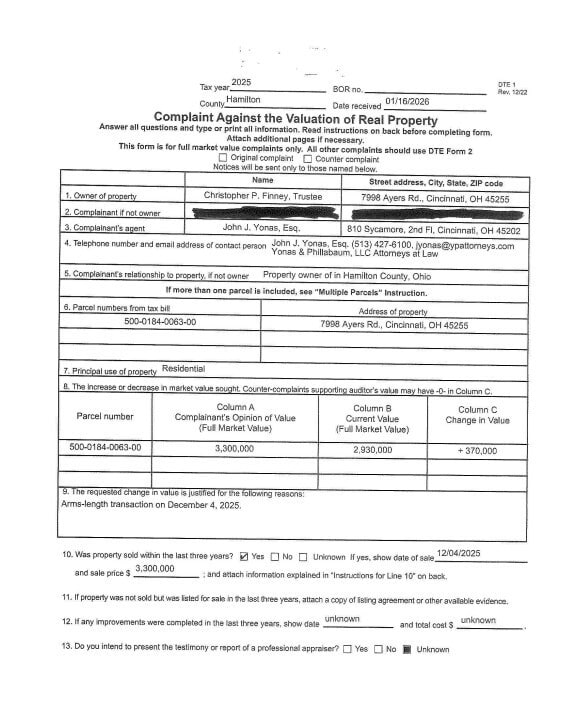

Step 1: Filing the Complaint (Form DTE 1)

The process officially begins when you file Form DTE 1 (Complaint Against the Valuation of Real Property). This form must be submitted to the county auditor where the property is located.

Who Can File a Complaint

In Ohio, several parties have legal standing to challenge a property’s valuation before the Board of Revision:

- Property owners—This includes any property owner within the county, not just those with an ownership interest in the subject property of the complaint. For example, an individual who owns a home, a business owning commercial property, or a landlord with rental properties anywhere in the county may file a complaint on any parcel.

- Tenants responsible for paying property taxes under the terms of their lease may also file a complaint if their lease agreement specifically makes them liable for property taxes.

- Other interested parties such as those with a legal or financial interest in the property, including mortgage holders, receivers, or trustees managing property assets.

- Local government entities, such as school districts, which may contest valuations when funding is affected.

When filing, you must clearly identify your relationship to the property on Form DTE 1. No matter the type of property—residential, commercial, or investment property—the owner or another qualified party has the right to challenge the assessed value if they believe it is incorrect.

Who Can Represent a Property Owner

A property owner may represent themselves throughout the Board of Revision process. Alternatively, representation is permitted by:

- Attorneys licensed to practice in Ohio

- Duly authorized agents (such as accountants, property managers, or designated representatives), although some Boards may have specific rules about non-attorney agents, so check with your county.

If you choose to use a representative, you may be required to provide written authorization or a power of attorney.

Accuracy is vital here.

The form asks for the specific value you believe is correct. You cannot simply guess; you must state a fair market value that you can prove. Errors on this form can lead to your case being dismissed before it even starts.

Step 2: Gathering Your Evidence

The Board of Revision will not lower your valuation just because you feel your taxes are too high. You must prove that the market value of your property is lower than the auditor’s estimate.

The burden of proof is on you. The most effective forms of evidence include:

- A recent arm’s-length sale: If you bought the property recently on the open market for less than the auditor’s value, this is often the best evidence.

- A professional appraisal: A certified appraisal with an effective date of January 1 of the tax year in question carries significant weight.

- Comparable sales: Data on similar properties in your neighborhood that sold recently.

- Evidence of condition: If the property has structural damage or issues that lower its value, provide photos and contractor estimates for repairs.

What Happens After You File a Complaint

Once your complaint is filed, several outcomes are possible even before a hearing takes place. In some cases, if the evidence you submit is clear and compelling—such as a recent arm’s-length sale or an appraisal that is not disputed—the county auditor or other parties may agree with your proposed value. When this happens, the complaint can be resolved through a “stipulation” or agreement between the parties, and the Board will simply confirm the new value without the need for a hearing. However, if there is disagreement or further clarification is needed, your case will proceed to a formal hearing.

Step 3: Attending the Hearing

Once your complaint is processed, the BOR will schedule a hearing. This is a quasi-judicial proceeding, but it is less formal than a courtroom trial. The board usually consists of representatives from the county treasurer, the county auditor, and the board of county commissioners.

During the hearing:

You will present your case and explain your evidence.

The board members may ask you questions.

Note: The local school board may also have an attorney present to argue against lowering the value, as schools are funded by property taxes.

Be professional, organized, and stick to the facts regarding the property’s value.

Potential Outcomes

A Board of Revision complaint can request that the property value be set either higher or lower than the current auditor’s value. After the hearing, the Board will deliberate and issue a decision by mail. There are generally three outcomes:

-

Reduction: The Board agrees the value should be lower and reduces the property’s valuation. You will receive a refund or credit on future tax bills.

-

No Change: The Board decides your evidence was insufficient to change the auditor’s original value.

-

Increase: The Board finds the value should be higher and raises the valuation. This may increase future tax bills.

If you disagree with the Board’s decision, you have the right to appeal to the Ohio Board of Tax Appeals (BTA) or the local Court of Common Pleas, usually within 30 days of the decision letter.

If you disagree with the Board’s decision, you have the right to appeal to the Ohio Board of Tax Appeals (BTA) or the local Court of Common Pleas, usually within 30 days of the decision letter.

Example of Complaint:

Summary

Challenging your property taxes is a powerful tool for Ohio homeowners and investors, but preparation is key. File your DTE 1 form accurately before March 31, and come to the hearing armed with concrete evidence of value. When you follow the process correctly, you ensure you only pay your fair share.

This is a legal advertisement. If you need language assistance, reach out to Yonas and Phillabaum LLC. John Yonas can be reached at [email protected].